Pivot Timeframe Indicator for MT4: Ultimate Instruction Manual

In the field of technical analysis, resonance tools such as the tipped points come in handy to provide traders likely turning points or levels of support and resistance. Of the several aids that have been developed in this regard, the Pivot Timeframe Indicator for MT4, is one of the easiest that helps the traders zoom into these levels in various timeframes in no time. In this article, we will focus on how effective pivot points are, how the Pivot Timeframe Indicator works and how it can change your trading style for the better.

What is the Pivot Timeframe Indicator?

The Pivot Timeframe Indicator is an instrument that works within the widely-used MetaTrader 4 (MT4) trading platform. This device helps to automate the process of deriving pivot points, therefore, indicating key resistance and support zones based on the price history. Such contours assist the traders in pinpointing possible turning points against the typical price action events such as the occurrence of strong trend changes or violent breakouts.

There are daily, weekly, and monthly pivot points that a trader is expected to calculate for effect. While the Pivot Timeframe Indicator is used, traders are able to assess how the instrument traded in relation to the mentioned levels.

How Does the Pivot Timeframe Indicator Work?

The Pivot Timeframe Indicator works by determining and illustrating the calculated pivot points on the selected timeframe. The calculation process usually consists of the following steps:

Pivot Point (PP) = (High + Low + Close) / 3

Resistance 1 (R1) = (2* PP) – Low

Support 1 (S1) = (2* PP) – High

Resistance 2 (R2) = PP + (High – Low)

Support 2 (S2) = PP – (High – Low)

Resistance 3 (R3) = High + 2 * (PP – Low)

Support 3 (S3) = Low – 2 * (High – PP)

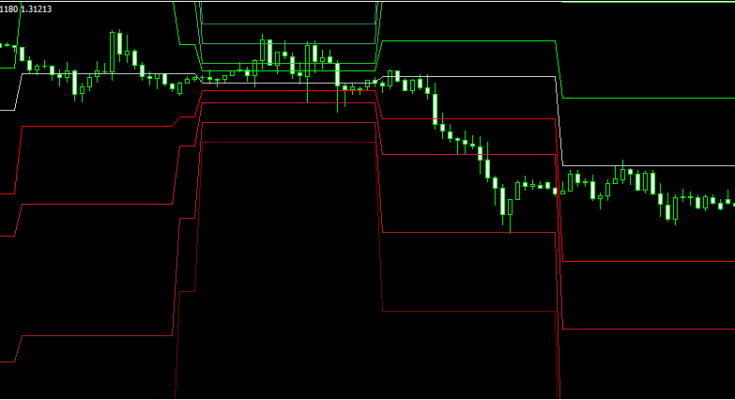

Here, these values help indicate the proposed pivot levels as regards the moment under consideration on the selected timeframe which will be essential in predicting major shifts in the market by traders. The indicator presented in the image depicts both the resistance (R) and support (S) levels and the central pivot (P) level.

Benefits of Using the Pivot Timeframe Indicator for MT4

The Pivot Timeframe Indicator has several benefits for traders that include:

Multiple Timeframe Analysis: The indicator enables viewing different pivot levels on various timeframes, which offers a picture of the key levels of the market. For example, it is possible to look at daily and weekly pivot points and see where two levels intersect, this would enhance trading strategies.

Support and Resistance Zones: It especially pinpoints support and resistance zones, making it easier for you to pinpoint breakout or reversal areas. These zones are helpful for entry or exit signaling thereby enhancing the timing of trades.

Versatility: Irrespective of the asset class and the market being active, be it forex, equities or commodities, pivot points prove to be useful wherever the market is. The Pivot Timeframe Indicator can be applied irrespective of the asset class being traded, hence it is quite a handy instrument in a trader’s kit.

Trend Confirmation: You can also use these pivot points as a way to confirm the trend that’s in play as well. Price trading constantly above the pivot level means the trader’s bias is bullish. In contrast, price trading below the pivot level signifies there is a bearish bias among traders.

Price Reversals: The indicator stands out in this regard as it alerts you to possible reversal zones where direction of the market is likely to change. Undoubtedly the most popular types are the R1, R2, R3, S1, S2 and S3 levels which encompass areas of forced price action either upwards or downwards and are suitable for entering a trade in the opposite direction of an existing trend.

Best Trading Strategies Using Pivot Timeframe Indicator for MT4

In order for investors and traders to gain the most out of the Pivot Timeframe Indicator for MT4, they are bound to add it to a trading strategy that accommodates them. Here are a few strategies that can help you leverage pivot points efficiently:

1. Pivot Point Breakout Strategy

Probably the most common strategy is the one in which all other strategies include trade breakouts based on pivot points. The key point of the method is the moment when the price goes beyond a pivot point that acted as resistance or support and the price heads in a new direction.

Buy Signal: In case price moves above the predefined resistance pivot level with the further moving ability being bullic, it offers favourable buy position since any move far above is bullish continuation breakout.

Sell Signal: On the other hand, A break below a support pivot level indicates negative forces in price and chances are that a bearish trend could initiate warrants a sell entry.

2. Strategy Using Pivot Points: Pivot Point Bounce Strategy

This strategy states that the trading should be conducted when the price approaches any support or resistance level and bounces back. The traders try to find out some rejections from these levels as a confirmation for the reversal of the trend.

Buy at Support: In such cases when the price hits the support level like support1 support2 or 3 or some S1 and starts shifting upwards, this sign indicates the opportunity to buy.

Sell at Resistance: Once the price reaches a level of resistance like R1 R2 or R3 and then starts to head back south, it is usually a good opportunity to go short.

3. Utilizing Pivot Points and Other Technical Analysis Together

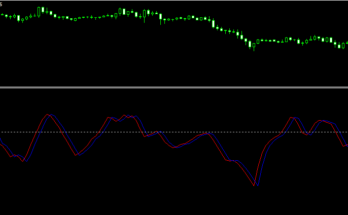

Polarity of pivot levels can be enhanced when other factors such as technical indicators are added. Which is why, it is recommended to use MAs, RSI and MACD along with pivot points.

RSI Divergence: If RSI is providing a divergence at a particular pivot level, it increases the chance of reversal at that level.

Moving Averages: Upon a break of a pivot, and price moving above a moving average provides extra confirmation of entry in the direction of the breakout.

MT4’s Pivot Timeframe Indicator: Installation and Operational Guide

There’s nothing complicated in installing and using the Pivot Timeframe Indicator for MT4. Just follow these steps to get started:

Download the Indicator: It is advisable for you to have a copy of the Pivot Timeframe Indicator for MT4. This can be obtained from reliable traders’ forums or websites.

Install the Indicator:

Launch MT4 after which click on the ‘File’ option.

Click on ‘Open Data Folder.’

In the opened window, click on ‘MQL4’, which is followed by ‘Indicators.’

Copy and paste the downloaded Pivot Timeframe Indicator file in this folder.

Activate the Indicator:

Go back to MT4 and right click on ‘Navigator’.

Click on “Refresh” and the indicator list will be updated.

Drag the Pivot Timeframe Indicator to the chart you want to analyze.

Customize the Settings: Depending on your trading strategy, you may change the settings for timeframes, colors, or level displayed. For example, some traders would want only a particular pivot level displayed or some would want to see only daily pivots and not weekly or monthly.

Signals within the system allow this analysis to be conducted in a way that sometimes displays calculated pivot points for the selected timeframe. It’s time to utilize these levels in your trading approach considering the price action within defined support and resistance zones.

Conclusion

The Pivot Timeframe Indicator for MT4 allows easy establishments of key support and resistance levels on multiple timeframes making it a core tool for any trader. Day traders seeking short-term profits or swing traders hunting longer-term trades will be well served by the pivot points, which strategically aid in the prediction of price action.

Adopting the Pivot Timeframe Indicator on top of your trading plan enhances the way you take trade, helps to spot upcoming market turning points, as well as refine the way you manage risk. This particular indicator is design to work on various tImeframe systems and when used with other training tools will help you out in your trade activities.

About this indicator, it would be best to try it on a practice account before switching to a real trading account. As proven by its users, the Pivot Timeframe Indicator for MT4 is capable of considerably increasing the trading performance.

Frequently Asked Questions

1. Is the periodicity or Pivot Timeframe Indicator useful for all asset classes?

The indicator can be used for everything-from forex and stocks to commodities and other assets.

2. Is it free to use The Pivot Timeframe Indicator Box?

Most of the versions of this indicator are free, but there are also paid sponsors available.