Profitable Supply and Demand Zone Trading For Smarter Investing

Supply and demand zone trading is a powerful method to trade. Traders use these zones to identify key areas on price charts. These zones show possible reversals and offer depth analysis for making profits through trading. This article will guide you through the details of supply and demand zone trading. We will also discuss why it’s very important to know for anyone who is serious about trading.

What are Supply and Demand Zones in Trading?

Supply zones are those areas on the chart where selling interest is high by traders and the trend can reverse. Demand zones are areas where buying interest is good enough to stop a downtrend and possibly reverse it. These zones are identified with the help of price action and understanding where significant buying or selling has happened in the past.

Understanding these zones can help to predict future price movements and make more knowledgeable trading decisions. If you are a trader and you identify these zones then you easily improve your trading success.

Why Are Supply and Demand Zones Important?

Supply and demand zones provide a clear picture of the market patterns and key levels. They show where buyers and sellers are most active, which can show possible price reversals or continuations. If you understand these supply and demand trading very well then it allows you to enter and exit trades at best points.

More than that, these zones offer good risk management. By understanding where the price is likely to reverse, traders can set up their stop-loss and take profit levels this way improving their risk-reward ratio.

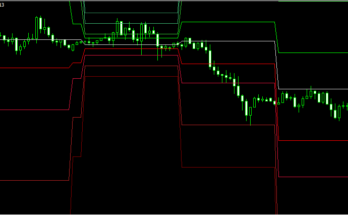

How to Identify Supply Zones on a Chart?

To identify supply zones, look for areas on the chart where past prices has reversed from an uptrend to a downtrend. These zones are often marked by significant price drops and can be identified by looking at the candlesticks with long upper wicks.

Another method is to use historical price data to find areas where large sell orders were placed. These areas often serve as resistance points, and price tends to react the same way when it revisits these zones.

How to Differenciate Between Supply and Demand Zones and Support and Resistance Levels?

While both ideas have the same concept, they are not the same. Support and resistance levels are levels drawn at price levels where reversals have happened many times. Supply and demand zones are wider areas that combine all the features of these levels and provide a more detailed view of price action.

Support and resistance levels are often used for quick trades, while supply and demand zones are more useful for understanding the wide side of the trading market. Using both together can provide a complete and thorough view of the market.

How to Draw Supply and Demand Zones in the Right Way)?

You should start by identifying key reversal points on the chart. You can mark the price reversal areas on your chart and then can draw a rectangle and extend the same area to cover the whole range of price movement during that reversal.

Always make sure that the zones should include the high and low points of the reversal period. You can also expect candlesticks with the big wicks in these zones.

How Do Supply and Demand Zones Affect Market Behavior?

These zones represent key areas of high buying or selling pressure and it shows how prices move. When price enters a supply zone, we can expect a selling pressure. It can cause a reversal or an uptrend. On the other side, entering a demand zone can lead to a reversal or a slowdown in a downtrend.

Traders often watch these zones closely and they plan their positions according to price action.

What Are the Key Points of Strong Supply and Demand Zones?

Strong zones are often marked by sharp price movements away from the area. They also point us to strong buying or selling interest. They are also tested many times, with the price respecting the zone over and over again.

Another feature is the quantity of trades in the same zone. If there is a high quantity can confirm the strength of a supply or demand zone, suggesting significant market interest in that price range.

How to do Day Trading with Demand and Supply?

If you are a day trader then these zones can help you to identify entry and exit points for trades. By watching for price action around these zones, traders can make quick decisions to take the best advantage.

Day traders often use these zones along with other technical indicators to confirm their trades. This way you can easily improve the quality of their trading and can give boost to overall performance.

How to use Supply and Demand Zones in Swing Trading?

Swing traders look for larger price movements, and supply and demand zones are ideal for finding these possible swing points. By focusing on these zones, swing traders can identify areas where price is likely to reverse over a longer period.

Combining these zones with other technical analysis tools can help swing traders develop strong decisions with their trades. This approach allows them to take trades with a better risk-reward ratio.

Common Mistakes to Avoided When Trading Supply and Demand Zones

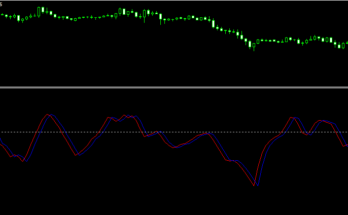

One common mistake is over-relying on these zones without other market factors. It’s extremely important to use supply and demand zones along with other technical indicators and basic analysis. We can take help from Rsi, MACD, and moving averages for second confirmation.

How to Confirm Supply and Demand Zones with Volume Analysis?

Volume analysis helps confirm the strength of a supply or demand zone. High trading volume in a supply zone shows strong selling interest whereas high buying quantity in a demand zone shows strong buying interest.

This information helps traders make smart decisions and avoid false signals.

Key Things to remember:

Identify Zones: Look for sharp reversals and good price movements to find supply and demand zones.

Volume Confirmation: Use volume analysis to confirm the strength of these zones.

Combine Tools: You should use other technical indicators for better analysis.

Risk Management: You should always setup a proper stop-loss and take-profit levels based on these zones.

Conclusion:

Supply and demand zone trading is a smart way to understand market behavior and make better trading decisions. By finding these zones on your charts, you can make better decisions in the areas where prices might reverse or continue. This helps you find good entry and exit points for your trades.

Using supply and demand zones along with other tools, like volume analysis and technical indicators can make you a good trader.

In short, mastering supply and demand zone trading can make a big difference in your success and can make you a good trader.

If you want to trade with the best forex broker click here